PRODUCER RESOURCES

WHAT THE DATA SAYS: PRODUCING LOW-BUDGET COMEDIES

In previous articles in this series, we’ve looked at what it takes to produce a successful horror movie, family film, or drama. Now we turn to the difficult art of making people laugh, searching for the common factors behind successful comedies.

Who Watches Comedies?

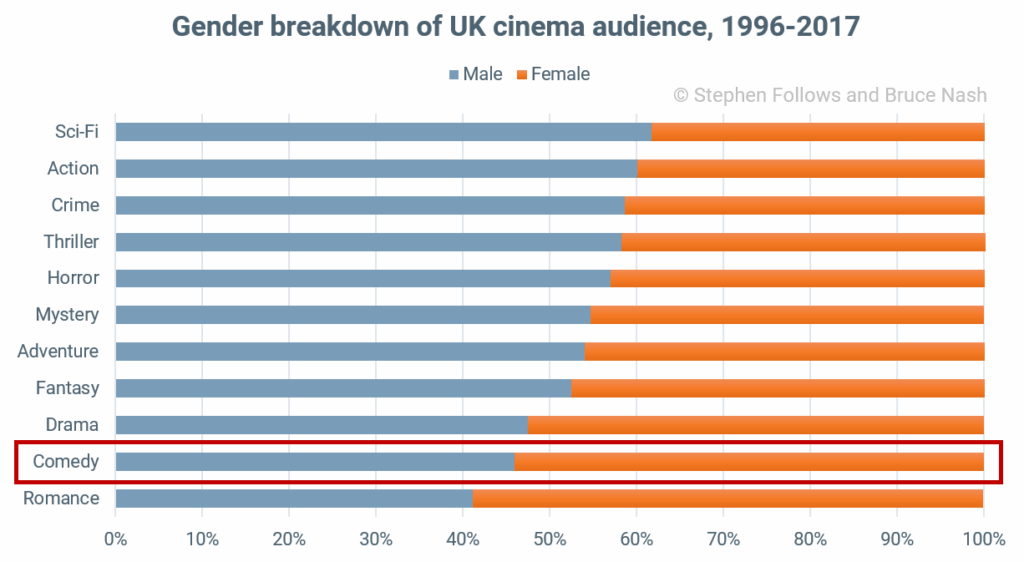

To understand how to make a comedy successful, we first looked at who watches them. We used data from UK cinema audience surveys by Pearl and Dean from the past twenty years to compare comedy films to those of other genres.

Let’s start with gender. At 54%, comedy had the second-highest percentage of women in their audiences, when compared all major genres, behind only romance (which stood at 59%).

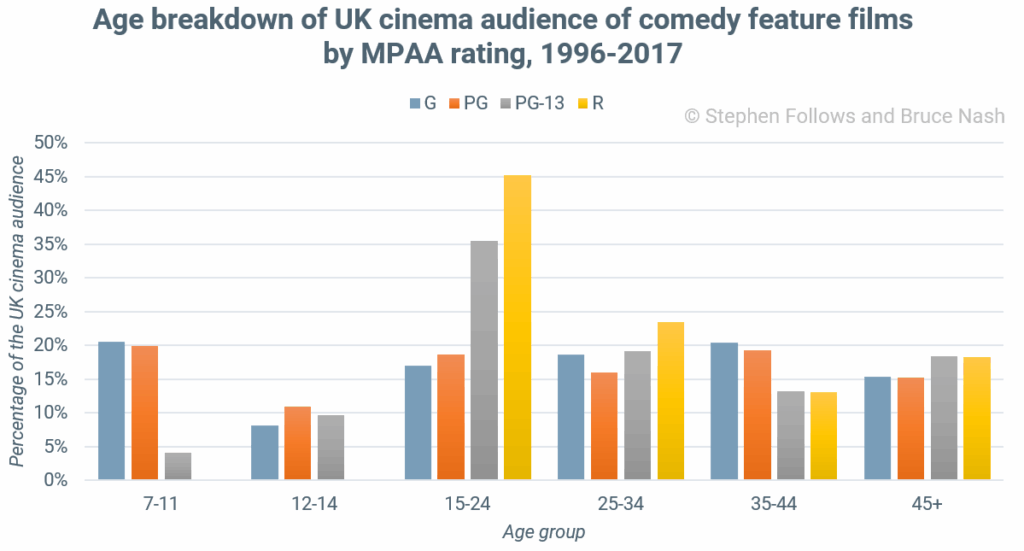

The other basic demographic category is age. To analyse this, we sub-divided the audience data by MPAA certificate to see how audiences differ between types of comedy.

As you may expect, no-one under 15 goes to see R-rated movies (well, not officially). 15 to 24 year-olds make up almost half of the cinema audience for R-rated movies. As you move up the age spectrum, the age split regresses to similar levels seen among G, PG and PG-13 rated movies.

Note the slight bump for G and PG-rated movies in the 35 to 44-year-old bracket – that’s because many are parents and their cinema choices are not entirely up to them!

What do these charts tell us? First, that family-friendly comedy works across the age spectrum. For example, if you walk into a cinema showing a G-rated comedy, you will find about as many people aged 35-44 as 7-11 year-olds, and only slightly fewer people between 15 and 24, or over 45. Partly, this is because parents take their kids to the movies, but there are also plenty of teenagers going to such films, as well as older film-goers.

Second, PG-13 and R-rated comedies appeal especially to 15-24 year-olds, with a relatively high number of young women in the crowd. Comedies make great date movies, of course.

So the demographics suggest that films should be targeted either at very general audiences, with a G, PG, or PG-13 rating; or at teens and young adults with a higher rating (probably R). In both cases, appealing to women and men is key.

Profitability

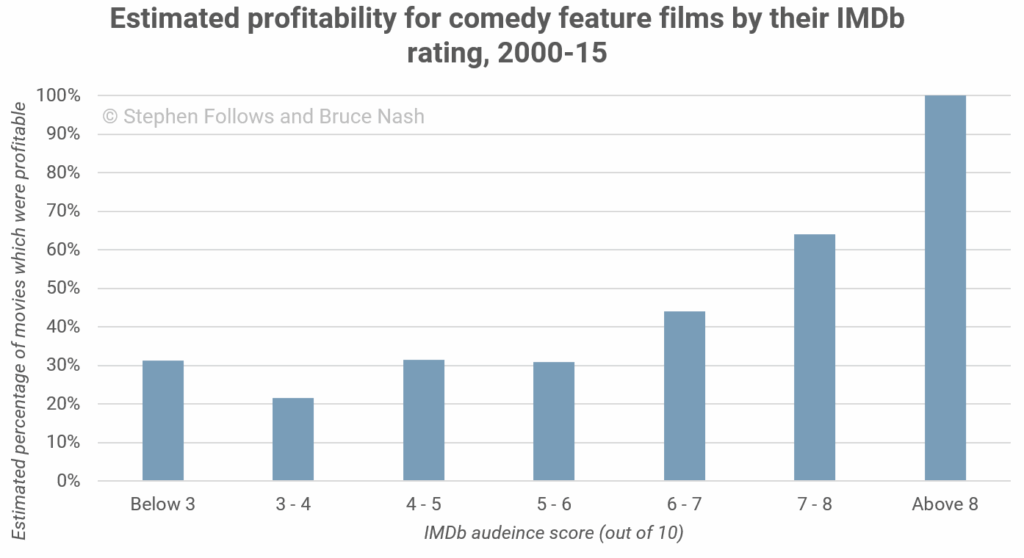

In a previous study we looked at correlations between different genres and their estimated level of profitability. By focusing on comedies, we can see that the budget of a comedy is not a strong indicator of likely profitability. That said, the lowest budget films appear to have the lowest levels of success, with just 35% of comedies budgeted under $1 million likely to turn a profit after all income and costs, compared to 52% of those budgeted over $125 million.

It’s worth noting that this study looked at films which reached US cinemas, and a huge number of sub-$1 million comedies do not get a theatrical release, whereas the vast majority of the biggest-budgeted films do get some sort of big screen release.

So what does correlate with profitability? Audience reviews. We estimate that fewer than a third of comedies with an IMDb score of under 6 out of 10 reached break even. By contrast, all of the comedy feature films we studied with an IMDb score of 8 or higher earned enough to be profitable (assuming industry standard deals and fees!)

Positive Messages and Role Models

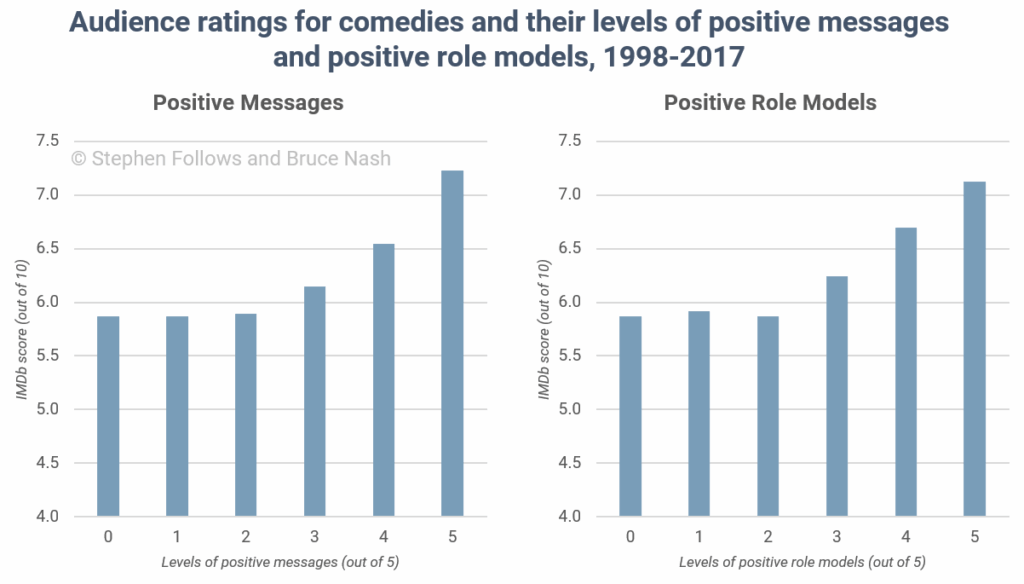

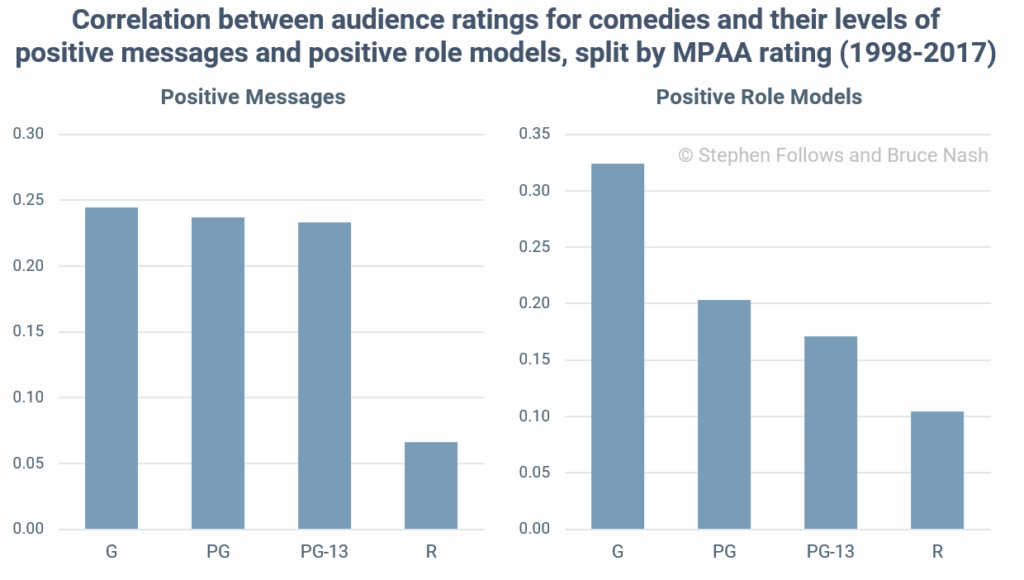

By using Common Sense Media ratings (to measure the content of movies) and IMDb user scores (to measure audience enjoyment) we can determine links between what’s in a movie and how much people enjoy it.

Of all genres, comedy has the highest correlation between levels of positive role models and audience enjoyment. The greater the role models, the higher the audience love.

Let’s zoom in a little more to see if this applies to all comedies. It seems that positive messages are appreciated in comedies rated G, PG and PG-13, but not R-rated movies. The charts below show the Pearson correlation coefficient, where zero means no correlation and one is a complete positive correlation.

How Do Comedies Travel?

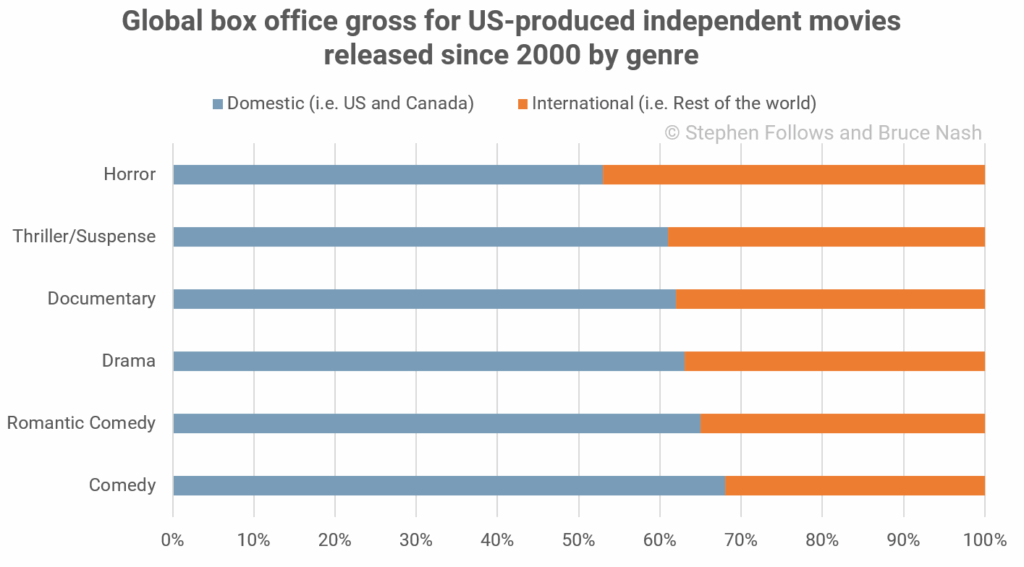

So we know who goes to comedies, but what do they watch? The answer is mostly locally-produced comedies. In fact, comedy is the genre that travels the worst internationally.

For example, below is the share of box office generated domestically for US-produced films with budgets under $10 million made since 2000. All genres at this budget level earn most of their box office in North America, but comedies are the most dependent on their local market: about two-thirds of the box office for US-made comedies comes from North America. Dramas and documentaries are a little behind, along with thrillers, all of which get about 60% of their box office from the domestic market. Horror, on the other hand, travels very well, with an almost even split between domestic and international.

How Does Star Power Affect Comedy Performance?

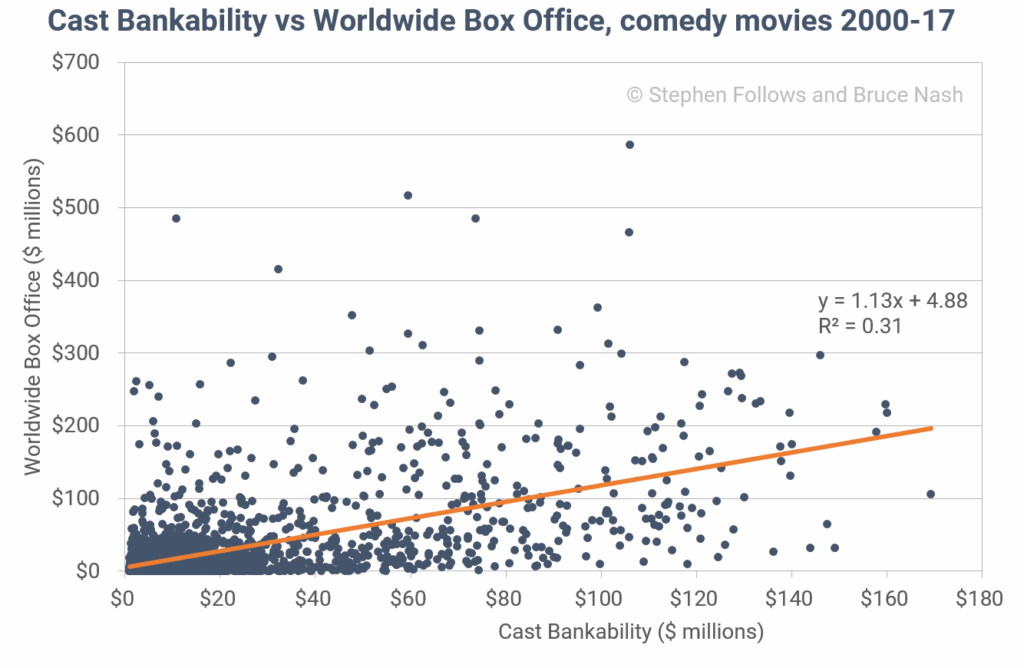

You may recall from our previous article on dramas that there is little correlation between the bankability of the stars involved and how much an independent drama makes at the box office. Comedies, however, have a much stronger correlation between star power and success.

You may recall that the relationship between star power and the success of dramatic features had an R² of 0.05, meaning virtually no relationship at all (a perfect correlation would have a value of 1). The correlation is much stronger for comedies, at 0.31.

In simple terms, only 5% of the success of a drama is down to who’s in it—the quality of the script, direction, and many other factors are critically important. For comedies, about 31% of a film’s success is determined by its cast. That’s not to say that quality isn’t important (it is!) but people are drawn to comedies with well-known actors more than with dramas. Of course, it’s also true that well-known comedians are, well, funny… which certainly doesn’t do any harm when it comes to making a comedy successful.

Conclusion

Over the course of these articles, we’ve seen how each genre has its own unique set of characteristics: for dramas, quality is king; family films rely on positive messages and careful tailoring for their target audience; horror films need good marketing to succeed.

Comedies are less constrained in some ways. They reach audiences across the age spectrum, and all sub-genres can work, from light romantic comedies to gross-out teen fare, family films to decidedly adult content. It also seems that comedies aren’t dependent on having a particular budget to succeed, which potentially makes life easier for the independent film-maker.

It’s worth bearing in mind that comedies don’t generally travel well. What’s hilarious in one country might be considered decidedly unfunny in other parts of the world. Language barriers can be particularly high for some forms of comedy, too. So it’s wise to focus on success in your home market and regard opportunities abroad as a bonus.

What helps with a comedy is a recognizable star. That’s easily done for a studio film, of course, but even for independent films, having someone well-known on the poster can help. With stand-up comedy having something of a golden era, that might not be as hard as it sounds.

Notes

- In the demographics section, we have used UK audience data with MPAA ratings. This was achieved by using Pearl and Dean data for each movie surveyed and then cross-referencing it with each movie’s MPAA certificate. This is not a perfect fit as UK cinemas don’t use MPAA ratings but we felt this was the best way of explaining our findings to our international audience who are unlikely to be familiar with the UK’s certification system.

- In the domestic vs international box office chart we’ve excluded genres for which we could find less than 20 movies in this budget range, which includes action and adventure.

For the profitability figures, we looked at 3,715 feature films released in US cinemas 2000-15 for which we have production budget information (a complete list can be found here). By using an algorithmic model we’ve developed from real-world data, we’re able to estimate the chance of each of our 3,715 films reaching profitability. This takes into account all income streams (from theatrical right through to syndication) and all costs (such as the budget, marketing and distribution costs).

About the Authors

Stephen Follows is a writer, producer and film industry analyst. His film research has been featured in the New York Times, The Times, The Telegraph, The Guardian, The Daily Mail, The Mirror, The Evening Standard, Newsweek, The New Statesman, AV Club and Indiewire. He acted as an industry consultant and guest on the BBC Radio 4 series The Business of Film, which topped the iTunes podcast chart, and has consulted for a wide variety of clients, including the Smithsonian in Washington. In addition to film analytics, Stephen is an award-winning writer-producer and runs a production company based in Somerset House, London.

Bruce Nash is the founder and President of Nash Information Services, LLC, the premier provider of movie industry data and research services and operator of The Numbers, a website that provides box office and video sales tracking, and daily industry news. Mr. Nash founded the company in 1997 and it now serves approximately 1,000 clients, from the major studios to first-time independent filmmakers. Mr. Nash provides regular commentary and analysis for media outlets, including the L.A. Times, the New York Times, Variety, the Wall Street Journal, 60 Minutes, and CBS News. Mr. Nash is the official adjudicator of movie records for the Guinness Book of Records. To learn more about his company’s services, visit Nash Information Services.

Copyright © 2021 Stephen Follows and Bruce Nash. All rights reserved. Reproduced with permission.

Explore more articles and research at Producers Resources.