PRODUCER RESOURCES

UPDATE: WHAT TYPES OF LOW-BUDGET FILMS BREAK OUT?

An investigative report from Film Industry Analyst Stephen Follows and Founder of The Numbers Bruce Nash

This is an expanded and updated version of last year’s article, “What Types of Low Budget Films Break Out,” which looked at the patterns behind low-budget breakout movies. We have added more data, dug deeper and widened the criteria to look at all movies budgeted below $3 million.

Many filmmakers and film professionals spend their careers chasing the elusive “low-budget breakout” movie. i.e. A film made for pennies that rakes in mega-bucks and in so doing transforms the careers, companies and cars driven by those involved.

This kind of success is often written off as a random event. However, this is far from the case. While nobody can provide a surefire formula for success, there are patterns we see time and again among the highest performing low-budget movies.

To reveal these patterns, we began with a list of over 3,000 films from The Numbers’ financial database, investigating full financial details, including North American (i.e. “domestic”) and international box office, video sales and rentals, TV and ancillary revenue. We narrowed our focus to study the 100 most profitable feature films released between 2007 and 2016, budgeted under $3 million, using a standard distribution model where the distributor charges a 30% fee.

We looked for common themes and found (with a small number of exceptions) that the breakout hits divided naturally into four types:

Model One: Extreme, Clear-Concept Horror Films

It will come as no surprise to producers that horror films feature prominently on the list of low-budget breakout successes.

- Most Profitable Films: Paranormal Activity, Insidious, Paranormal Activity 2, Sinister, [REC].

- MPAA Rating: 75% are rated ‘R’, 15% PG-13 and 10% not rated.

- Running Time: Relatively short, with an average of 95 minutes and no film running over two hours.

- Critical Reviews: Average to poor. The highest rated film in this category is It Follows, which has an impressive Metascore of 83 out of 100 but it is the outlier. The average Metascore across the dataset is just 53 out of 100.

- Audience Reviews: More supportive than the critics, but still not above average for most films, at an average of 6.1 out of 10 on IMDb.

- Release Patterns: Two very distinct release patterns – half played in fewer than 100 theatres and made most of their money on video, while the other half played in over 1,500 theatres.

- Income Streams: 25% from theatrical, 64% from home video and 11% from TV and other ancillary income.

- Income Location: 36% of income was from the US & Canada and 64% international.

Model Two: Documentaries with Built-In Audiences and/or Powerful Stories

The second group of films that stood out were documentaries.

- Most Profitable Films: Exit Through the Gift Shop, Man on Wire, Shine a Light, Senna, The September Issue.

- MPAA Rating: A healthy spread across all ratings, with the most common being PG-13.

- Running Time: Average of 99, although a wide range from 80 minutes up to 144 minutes.

- Critical Reviews: Very high, with a Metascore average of 78 out of 100.

- Audience Reviews: Very high, an average IMDb rating of 7.8 out of 10.

- Release Patterns: Small number of theatres, with most playing in under 250 theatres and the widest release being An Inconvenient Truth in 587 theatres.

- Income Streams: 14% from theatrical, 74% from home video and 12% from TV and other ancillary income.

- Income Location: 57% international and 43% domestic.

Critical reviews seem vital for this type of film to break out and it’s interesting that the documentaries with the lowest scoring critical ratings (The September Issue at 69 and Religulous at 56) both had strong inbuilt audiences (‘Vogue / fashion’ and ‘Bill Maher / religious scepticism’).

In fact, only a handful of the documentaries on the list don’t have an obvious audience: Man on Wire, Anvil: The Story of Anvil, and Searching for Sugar Man are the only ones that needed to find a crowd. The others were either about someone who was already very famous (Marley, Tyson, Senna, Amy… note the one-name titles!) or played directly to a receptive audience (Inside Job, Blackfish, An Inconvenient Truth etc).

Model Three: Validating, Feel-Good Religious Films

Speaking of receptive audiences, the third group of films we found were faith-based films.

- Most Profitable Films: War Room, God’s Not Dead, Fireproof, Courageous, Facing the Giants.

- MPAA Rating: Two-thirds are rated PG and the remaining third are PG-13.

- Running Time: Fairly long, all are over 110 minutes and the average is two hours.

- Critical Reviews: Incredibly poor, with an average Metascore of just 30 out of 100.

- Audience Reviews: Similar to the horror pool, with an average IMDb rating of 6.4 out of 10.

- Type of Release: Nationwide, but carefully targeted. The films played in an average of 1,273 theatres with the widest being War Room at 1,945 theatres.

- Income Streams: 23% from theatrical, 63% from home video and 15% from TV and other ancillary income.

- Income Location: 98% of income came from North American sources with just 2% coming from outside the US and Canada.

Two things stand out with these films. First, they make virtually all of their money in the United States. Second, they get very bad reviews from mainstream movie reviewers. The strength of these movies isn’t their quality so much as their message: they deliver to an audience that is already interested in what they have to say.

Model Four: Very High-Quality Dramas

At the other end of the spectrum (at least in the eyes of professional film reviewers) are very high-quality dramas. Almost half of these films were American productions, with the rest coming from a wide variety of countries including Germany, Argentina, Mexico, the UK, France and Poland.

- Most Profitable US Dramas: Waitress, Moonlight, Winter’s Bone, Half Nelson, Fruitvale Station.

- Most Profitable Foreign Dramas: The Lives of Others, This is England, I’ve Loved You So Long, Bronson, Ida.

- MPAA Rating: Over half are R-rated, with a quarter not rated and the rest PG-13.

- Running Time: A wide range, from 81 minutes up to 154 minutes long.

- Critical Reviews: Extremely high, with an average Metascore of 82 out of 100.

- Audience Reviews: Similarly high, with an average IMDb rating of 7.3 out of 10.

- Type of Release: Small release, with all but four playing in fewer than 300 theatres.

- Income Streams: 20% from theatrical, 69% from home video and 11% from TV and other ancillary income.

- Income Location: 66% of income for US dramas came from the US and Canada, whereas the reverse was true with non-US dramas, with 64% of income coming from international sources.

The lowest-rated film in this category received a Metascore of 71 out of 100, which was higher than all but three of the films within the Horror breakout success category.

A common thread among these films is awards attention. While they may not all be big enough to win main category Oscars, at the very least, these films have picked up a bunch of Independent Spirit Awards, Best Foreign Language Film at the Academy Awards, and got some screenwriting and/or acting Oscar nominations.

What’s New?

The 2016 version of this article focused on movies costing between $500k and $3 million with an estimated Producers Net Profit of over $10 million, released 2000-15. In this updated version, we have expanded the criteria for inclusion (to all movies budgeted under $3 million), included more movies (from 63 to 100) and narrowed the time-frame (2007-16).

The previous criteria resulted in no action movies, no thrillers, no musicals and almost no comedies or movies directed at children. Our expanded list is slightly more diverse, with one musical, a few thrillers and comedies.

Aside from the missing genres, the other notable absence is major star involvement. Of course, this is largely a function of the budget—it’s hard to get Tom Cruise for a $3 million film—but it’s remarkable how few of these films attracted anybody who would even be called a B-list star at the time the film was made.

The 2017 expanded list led to the inclusion of a few films starring familiar names: Kevin Bacon in Cop Car, Kirsten Dunst in Bachelorette, Kurt Russell in Bone Tomahawk, and Kristen Wiig in Girl Most Likely, for example. So we’re not completely ready to drop the “don’t worry about named talent” observation – getting a well-known actor or actress into a leading role can clearly help.

The Evolution of Low-budget Movies?

One trend that we noticed in this 2017 redux was that there seem to be slightly fewer breakout hits in recent years.

The only films from 2016 that make the list are Oscar-winner Moonlight and New Zealand indie Hunt for the Wilderpeople. That may be because we are missing some recent films that haven’t yet earned enough on video to crack the top of the chart, but it also might reflect the fact that independent films are increasingly picked up by the likes of Netflix and Amazon for fixed fees.

That’s generally good business for all involved: the film-makers get their money back early, probably making a decent profit, and the streamer increases their library of exclusive films. But those films also don’t get the chance to break box office records, or earn a small fortune on video. The risk is reduced, but so is the potential reward.

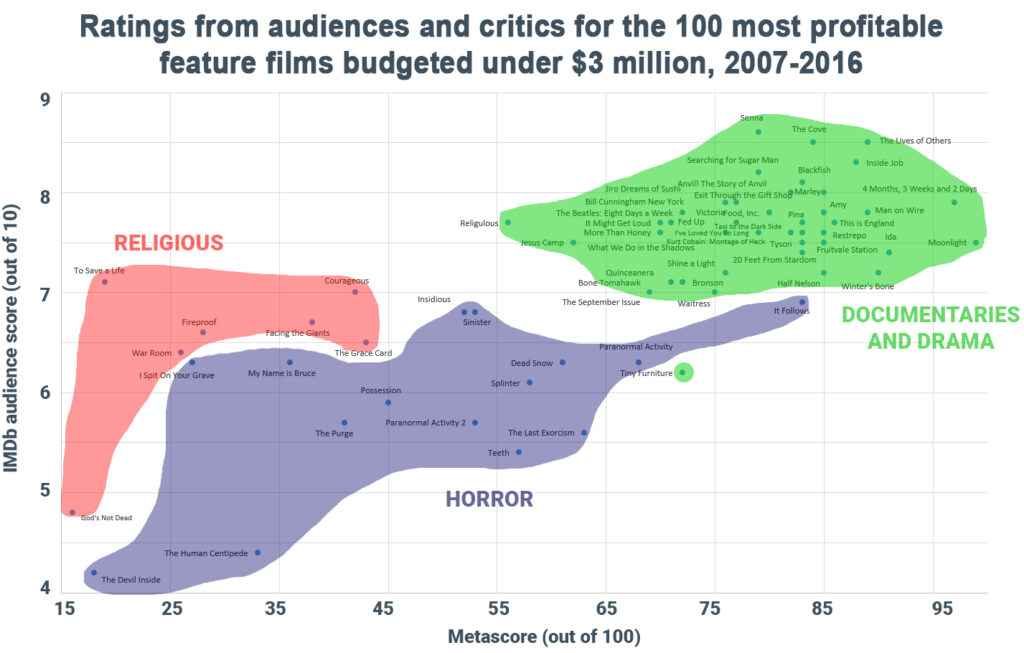

Do the Films Have to be Any Good?

An interesting finding from this research is that quality is only relevant for certain types of films.

- Religious films received extremely low ratings from critics and had mixed ratings from audiences.

- Horror films showed a range: some were disliked by both audiences and critics (such as The Devil Inside), while others had middling support from both camps (such as Monsters) and then there were films which audiences enjoyed but critics were lukewarm towards (such as Dead Man’s Shoes).

- Documentaries and Dramas were all popular with audiences and the vast majority also received extremely high ratings from critics.

If we plot this on a graph, we can see just how distinct the three sub-categories are.

Lessons for Filmmakers and Producers from this Research

We think there are a few lessons for independent filmmakers who are hoping to make breakout hits:

- Some “niche” audiences are large enough to make for a very profitable market, if you can reach them. The “faith-based” film audience stands out, but there are also receptive audiences for certain types of documentaries. Having a very clear idea of your audience is the first step to making a financially successful film.

- If you’re aiming for a more general audience, quality matters. A lot. Honing your screenplay to perfection and then having it ripped apart at a workshop may be hard work, but it’s almost certainly what it takes to get a dramatic film to connect with audiences, and to make back its investment.

- Look for good actors, not big stars, and do the same with all of the technical crew on a film. Fun fact: Affonso Goncalves, who edited list member Beasts of the Southern Wild also edited fellow list member Winter’s Bone and 2016 Oscar nominee Carol. Finding a good editor, cinematographer, production designer and other key members of the crew is more important for a low-budget film than blowing a big chunk of your budget on a famous (or, just as likely, previously-famous) actor or actress.

- A theatrical release isn’t the only path to success. Bachelorette, for example, earned only $446,770 at the domestic box office, but over $8 million on VOD platforms. That’s the kind of performance we will see more and more in years to come.

Notes

- In order to conduct this study, we began with a list of over 3,000 films from The Numbers’ financial database, investigating full financial details, including North American (i.e. “domestic”) and international box office, video sales and rentals, TV and ancillary revenue. We narrowed our focus to study feature films released between 2007 and 2016 and budgeted below $3 million. Finally, we calculated the likely profit margin for the producers, after all revenue and expenses were taken into account.

- The home video numbers include DVD retail sales, Blu-ray retail sales, Physical disc rental (e.g., Redbox), Transactional VOD, Electronic Sell-Through, Subscription VOD and Ad-supported VOD.

- For the other categories, TV licensing includes premium cable, basic cable, and free TV. Ancillary revenue is other IP licensing (e.g., posters, soundtrack royalties) and licensing for in-flight entertainment.

- The financial figures come from a variety of sources, including people directly connected to the films, verified third-party data and computation models based on partial data and industry norms. Some of the individual figures will be different to our estimates though, en masse, we are confident of the larger picture.

About the Authors

Stephen Follows is a writer, producer and film industry analyst. His film research has been featured in the New York Times, The Times, The Telegraph, The Guardian, The Daily Mail, The Mirror, The Evening Standard, Newsweek, The New Statesman, AV Club and Indiewire. He acted as an industry consultant and guest on the BBC Radio 4 series The Business of Film, which topped the iTunes podcast chart, and has consulted for a wide variety of clients, including the Smithsonian in Washington. In addition to film analytics, Stephen is an award-winning writer-producer and runs a production company based in Somerset House, London.

Bruce Nash is the founder and President of Nash Information Services, LLC, the premier provider of movie industry data and research services and operator of The Numbers, a website that provides box office and video sales tracking, and daily industry news. Mr. Nash founded the company in 1997 and it now serves approximately 1,000 clients, from the major studios to first-time independent filmmakers. Mr. Nash provides regular commentary and analysis for media outlets, including the L.A. Times, the New York Times, Variety, the Wall Street Journal, 60 Minutes, and CBS News. Mr. Nash is the official adjudicator of movie records for the Guinness Book of Records. To learn more about his company’s services, visit Nash Information Services.

Copyright © 2021 Stephen Follows and Bruce Nash. All rights reserved. Reproduced with permission.

Explore more articles and research at Producers Resources.