THE FULL COSTS AND INCOME OF A £1MILLION INDIE FILM

Grab a cup of tea – this is a long one. It’s rare for filmmakers to get a candid look at the books of someone else’s film but, thanks to the generosity of Marcus Markou, that’s exactly what you’ll get to read below.

Papadopoulos & Sons tells the tale of an Anglo-Greek self-made millionaire who loses everything in the banking crisis and is forced to turn to his estranged brother to re-open the fish and chip shop they shared in their youth. It’s a fun family film starring Stephen Dillane, George Corraface and Georgia Groome.

The film was written and directed by first-time filmmaker Marcus Markou and was released in UK cinemas in April 2013.

Before we delve into the journey of the film, we need to take a moment to learn more about Marcus and his motives. Marcus is a successful entrepreneur, so much so that he was able to pay for the film’s £825,000 budget from his own bank account.

He wanted to learn how films are made, make something for his kids to see and have a fun time in the process. He’d taken a short course at the Met Film School but other than that, this was his first foray into the commercial film world.

The Budget

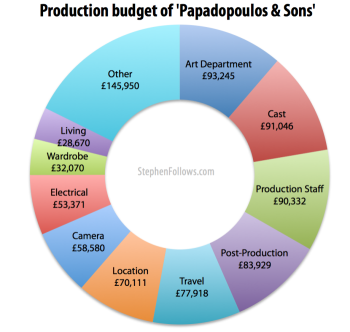

The film took 24 days to shoot in and around London. The largest costs were art department (they had to build a chip shop in an empty shop!), cast and production staff. The Above The Line costs came to £91,821 (11% of the budget), production was £584,800 (71%), post-production £109,436 (13%) with other costs coming to £39,165 (5%).

- £775 Story, Rights & Continuity

- £91,046 Cast

- £19,014 Supporting Artists

- £90,332 Production Staff

- £93,245 Art Department

- £32,070 Wardrobe

- £16,782 Make-up / Hair

- £53,371 Electrical

- £58,580 Camera

- £16,882 Sound

- £77,918 Travel / Transportation

- £28,670 Hotel / Living

- £70,111 Location

- £27,343 Overtime / 2nd Camera

- £ 482 Digital Stock & Transfers

- £25,507 Music

- £83,929 Post-Production

- £ 9,307 Insurance

- £ 2,556 Legal & Clearances

- £ 7,705 General Expenses

- £ 2,900 Publicity

- £ 750 PACT & Training Levy

- £ 15,947 Fringes

- £825,222 Total

I’m focusing mainly on the numbers today but if you want to know more about the story of the shoot then here are a few entertaining links…

- A podcast with Chris Jones interviewing Marcus

- The official 35 minute “Making of…” film

- Marcus’ blog written during the film’s production and distribution

Getting the Film Distributed

Marcus made the film without any industry support and without any distribution deals in place. This meant that once it was complete he had to figure out how he was going to get it to the public and recoup his investment.

At one point, he was close to signing a deal with YouTube to premiere the film online via a ‘pay what you want’ recoupment model. The idea seemed to be well-received at google but in the end the deal stalled when YouTube insisted that Google Wallet was used to collect the donations, despite the fact it was only active in 8 countries at the time.

Marcus turned to self-distribution in the UK and collaborating with a producer’s rep for the international rights. He signed up with producer reps 7&7 who would take 20% of any deal they negotiated but they wouldn’t ever control the distribution of the film, as a traditional sales agent would. Marcus was on the hook for the sales costs (such as attending Cannes and other film markets) but this would be recouped first from income.

Soon after taking the film to the Cannes Marche du Film (the film market where the rights to films are bought and sold), 7&7 secured distribution deals for Greece, Germany and an airline distribution deal.

The Film Festival Circuit

Many independent films rely on the festival circuit to get noticed, however Papadopoulos & Sons wasn’t shortlisted at a major film festival. Marcus puts this down to the film not being “an edgy, film festival kind of film”.

However, some festivals did take it, including…

- Dinard British Film Festival. It was screened ‘out of competition’, although a second screening was put on to satisfy audience demand.

- Thessaloniki Film Festival where it won the Michael Cacoyannis Audience Award.

- Palm Springs Film Festival

- Seattle International Film Festival

Reflecting on his festival experience Marcus said “The film isn’t arthouse; it is too commercial. But it isn’t a big studio film with celebrities in it, so it is arthouse. It is stuck between those worlds, commercial arthouse. In the UK, those worlds don’t really mix.”.

One of the more surreal screenings was in the European Parliament. A member of the film’s cast knew the programmer of cultural events and told him it was a film about the Greek banking crisis (it’s not). The resulting screening took place at the same moment that the Greek Prime Minister was on the floor negotiating Greece’s bailout deal.

Securing a UK Cinema Release

By this point, the film had a German, Greek and airline deal but was still lacking a UK distributor. Marcus is not someone who gives up easily, and so he turned to self-distribution. Via Miracle Communications, Marcus struck a deal with Cineworld cinemas which placed the film in 13 screens for a week.

Marcus identified Greek communities throughout the UK by looking for Greek Orthodox churches. If there was a church, he’d target the local community, using a variety of off- and on-line media.

The Costs of the UK Theatrical Release

Marcus secured a small release in 13 Cineworld cinemas, opening on 5th April 2013. By contrast, the biggest film of that week, The Croods, was playing on 553 screens across the UK. It is fairly common for large studio-backed films to get a much larger release than smaller, indie films, in part because the UK is one of the most costly regions in the world to release a film theatrically.

As Marcus was acting as his own distributor he had to pay up front for a number of costs (known as P&A, after Prints and Advertising). These included…

- £ 5,200 Tenancy fees

- £ 325 Virtual Print Fees

- £ 1,000 BBFC certificate

- £ 2,000 Renting DCP drives

- £ 2,000 Publicist

- £ 4,000 Miracle Entertainment (who coordinated the deal)

- £ 3,000 Radio ads on London Greek Radio, and print ads in Greek newspapers in London

- £ 8,000 Facebook ads, to those with “Greek interests” living in areas close to Greek churches

- £10,000 Posters, flyers and pre-release screenings of the ‘Making of’ documentary

- £35,525 Total

Note: These figures are approximations from Marcus, whereas most of the other numbers in the article are correct to the pound as they come directly from his accounts.

How the Film Performed in UK Cinemas

Early on in the three month campaign for the UK release, Marcus had been told that he should aim to achieve “500 per cinema” in the opening weekend. He took this to mean 500 admissions per cinema and set his sights on reaching this goal. He later learned that in fact the target was just £500 per cinema, which is under a sixth of what he was working towards.

In the opening week, across the 13 sites, the film sold 8,000 tickets and grossed £60,659. This means the site average was £2,870, the second highest of the week, beating fellow opening film Dark Skies (site average: £2,680) and GI Joe: Retaliation (site avenge: £2,421) which was on its second week of release.

The high per screen average spurred Cineworld to widen the release meaning that in the second week the film was screening on 16 screens. The vast majority of Marcus’ marketing efforts had been focused on driving people to see it during the all-important opening weekend. This can be seen in the box office figures, where, despite being available on 23% more screens, the film grossed just 31% of its opening weekend (£18,504).

After seven weeks on general release, the film finished its official UK theatrical run. It had grossed £95,509, according to Rentrak, although Marcus points out “I don’t think this includes indie screenings I’ve done because a lot of them come direct to me”. The overall per screen average of its seven weeks was a very respectable £2,274.

Dividing up the UK Theatrical Box Office Income

So, what happens to the money gathered by UK cinemas; i.e. the UK box office gross? Using Rentrak’s figures…

- £96,000 gross

- Minus tax (VAT at 20%) leaves £76,800

- Minus Cineworld’s cut (at 65%) leaves £26,880

According to Marcus’ accounts, he received a total of £45,601 from the UK release, which suggests that he was right to point out that the true box office figure was higher (£162,850 by my calculations).

Normally at this point a distributor and sales agent would take a fee and also take back their marketing costs (see here and here for more details) but as Marcus was self-distributing, he saved himself these costs. It’s reasonable to assume that had he taken the traditional releasing model then he would be left with far less, if anything. (Although it’s technically possible that a large distributor would have been able to secure more screens and therefore a higher box office gross).

After we remove the approximately £35,000 he spent on the digital prints and advertising (known as P&A) he is left with £10,600 profit for his six month’s work.

UK TV Deal

For the last few years, television has been the largest driver of income for British films and that’s certainly the case for Papadopoulos & Sons. The UK cinema release netted Marcus a profit of £10,000 for half a year’s work whereas by contrast his deal with the BBC netted him £50,000.

Ordinarily, the sales agent (7&7) would have taken a 20% cut but it had been agreed that Marcus would keep the full figure to recoup money he’d spent promoting the film in Cannes.

The BBC deal is for five screenings over the next five years, starting in autumn of this year. The deal stipulates that during the first two years, the BBC have the exclusive “UK Free TV’ rights, meaning that the film will be removed from the UK edition of Netflix until autumn 2017. Clauses such as this are fairly standard and explains why Netflix has different inventories between territories.

UK Film Tax Credit

The biggest cheque Marcus received was from the UK taxman, in the form of his rebate for the UK film tax credit. If your film is certified as officially British then the tax credit will give you 20% cash back on the money you spent in the UK on certain costs. The eligible costs are confined to activities within pre-production, production and post-production; meaning that all the money Marcus spent on distribution, exhibition and marketing are not included in the calculation.

In the case of Papadopoulos & Sons, the UK film tax credit came to £156,000, or 19.1% of their overall production budget.

German Income

In Germany the film opened on 70 screens, showing to 23,850 people and grossing €141,000 (£120,000) in its first week alone. After a month, the film had grossed €223,240 (£159,770) according to InterPlan, and Box Office Mojo has the final German box office gross at $289,670 (£197,000). The company with the German rights also released the film in Austria and so all told the gross was £215,929.

In return for the German and Austrian rights, Marcus had agreed an advance payment of €20,000 known as a Minimum Guarantee (an “MG”), which translated into a payment of £15,594. From the £216,000 box office gross, the distributor was permitted to recoup their costs, the money they spent on advertising and this MG. This meant that Marcus received no further payments for the theatrical or DVD releases in Germany and Austria.

However, the German distributor did negotiate a TV deal in France and Germany, which netted Marcus an additional £36,072.

Due to the lucrative TV deal, the MG has been repaid meaning that Marcus will receive 50% of the net income of DVD sales in Germany and Austria.

Greek Income

Considering the film’s plot, Marcus’ background and the press surrounding the EU screening, the territory of Greece was always going to be a big one for Papadopoulos & Sons. As with Germany, Marcus agreed an MG, in this case of €15,000. This translated to a net income of £12,753.

And there the Greek information trail stops. Neither Marcus nor I can find any Greek box office figures, DVD sales or how it performed in TV. It is fairly common in the film industry for distributors not to provide additional information and filmmakers are pretty much powerless in preventing it. The MG is often regarded as the only money the filmmakers will see from the deal and so distributors don’t see the need to provide them with updates on the film’s progress. When I asked Marcus what he felt the gross Greek figures were he said “Who knows… I am going to say £50k because I know its been on Greek TV and DVDs have been sold, etc”.

Update: I been tipped off that there are admission figures on Lumiere, although not financial figures. Apparently the film was seen by 2,676 people in Greece in 2012 and a further 2,906 in 2013.

Video on Demand Income

Most filmmakers are hoping that Video on Demand (VOD) income will grow to replace the lost income from falling DVD sales. Papadopoulos and Sons is available on a number of VOD platforms including…

- £19,602 Netflix (UK and USA)

- £ 2,902 FilmFlex (UK)

- £ 2,889 iTunes (multiple countries in Europe, UK, Africa and middle East)

- £ 26 Blinkbox (Europe)

- £ 95 Google (UK)

- £ 9,428 Misc VOD*

- £34,942 Total

*These misc payments come via the same aggregator as most of the other payments (The Movie Partnership) but the bank statements don’t reveal which VOD platforms the amounts belong to. Marcus believes that iTunes sales account for around 80% of the ‘transactional VOD’ revenue (i.e. not including Netflix, which offers ‘subscription VOD’).

The Netflix deal is for the UK and America and the gross is around £15,000 per year for a two year deal. The sales agent takes 15% and the aggregator takes a further 15%, leaving Marcus with 70% of the gross.

The film has performed well on the platform, with an average rating of 3.6 stars from nearly 120,000 ratings. Marcus says that Netflix have indicated they want the film when they roll out to new territories across the world.

Other Income

The film picked up other money from a few places…

- £9,374 DVD sales in the UK, Australia and New Zealand plus an Amazon-only deal in America. The Australian deal was for two years and they paid a £1,000 MG upfront.

- £7,457 Spiritual Cinema DVD club

- £2,187 TV deal across the Middle East

- £1,131 American theatrical screening via ’theatrical on demand’ company Gathr

- £ 275 Speaking fees related to UK film industry events

Totaling the Income

It’s certainly possible that the film will recoup more money in the coming years so these figures are true up to 15th April 2015.

- £158,000 UK tax credit

- £ 88,259 TV

- £ 45,601 UK theatrical

- £ 34,942 VOD

- £ 32,667 Airline

- £ 15,594 Germany theatrical

- £ 12,753 Greece

- £ 9,374 DVD

- £ 1,131 US screening

- £ 459 UK screening

- £ 275 Speaking fees

- £399,055 Total

Totaling the Costs

If we add up all of the costs of making the film (£825,222) with the rough costs of the UK release (£35,000) then we can see that the film cost Marcus approximately £860,000.

With income to date of £399,055, this means that the film is currently at a loss of around £460,000.

Note: You can see the full budget and costs at the bottom of this article.

I know this loss sounds like a lot but consider Marcus’ reasons for making the film. He wanted to learn how films are made, make something for his kids to see and have a fun time in the process. Marcus spent his own hard-earned money and was well aware of the risks.

I asked Marcus how he feels about the current recoupment status. He said…

Think of this as a long-term investment. The capital is sunk up front. After a couple of years I am 40% recouped. The hope is that after 10 years I will be fully recouped. But because of the strength of Netflix and BBC it’s clear this film will have a long shelf life. In year 11, that means every penny that comes in will be PROFIT! Think about it. If in year 11, I am making £25k per year that is £25k per annum with NO COST. This is why catalogues of old films are so valuable. Because if you have 20 films like this, making £25k per annum with no costs… well, you can do the Maths.

You must not underestimate the long-term value of a movie once its sunk capital has been recouped. In the West End a musical will have to run for two years before it’s profitable. Most never get to the two year mark. With a movie, if you have a universal story that has a long shelf life, you can be collecting payments for 20 or 30 years.

So I would always argue that this is a long haul investment. If I took the same £1m and put it in a bank, you may find that after 20 years Papadopoulos has out performed on a return many times over.

This is the recoupment stage but it is also still selling – e.g the US DVD and possible impact of Netflix rolling out across multiple territories. You say, existing deals MAY continue to pay out. They WILL continue to pay out because I get paid quarterly and for DVD, VOD, Netflix etc. Not in advance. So many deals are not completed yet (e.g Netflix) so it’s not a MAY it is a WILL.

Future Income

It’s likely that the film will recoup more money. There is a full American DVD release due in October (the previous US DVD deal was exclusively with amazon) and 7&7 are actively pursuing deals in new territories.

In addition, the existing deals may continue to pay out, certainly the Netflix deal seems to be going well and the film continues to sell via iTunes et al. The UK Netflix deal will be on a two year hiatus but if it continues to prove popular then it’s reasonable to assume that they will extend and widen the existing deal.

When the film begins its five year screening period with the BBC this autumn it could lead to TV deals in other territories. TV remains the most lucrative media format for the film and so a few more TV deals could produce £10,000’s more.

Lessons for Independent Filmmakers

Whilst this may not look like a sustainable model for filmmakers to follow there are a number of valuable lessons we can learn from these numbers…

- Self distribution is not easy. Marcus spent a huge amount of time and effort to secure the UK release, and then again to get the film in front of his target audience. There’s no doubt that a large amount of the success the film had in UK cinemas was down to his dedication, hard work and unwillingness to give up.

- Who you know, helps. At a few different points along Marcus’ journey it proved vital for him to trade on relationships with the right people. Cineworld only agreed to having the film screened in their flagship Shaftesbury Avenue site because one of Marcus’ employee’s flatmates was the manager. That said, Marcus isn’t the son of a famous filmmaker and so all his connections had to be earned. Anyone who’s met him will attest to the fact that it doesn’t take long after first meeting Marcus to want to do him a favour.

- The cost of deliverables adds up. Deliverables are the assets you pass over to a distributor after you sign a deal. These will include a copy of the film but also audio and image elements. For Marcus’ deals in Germany, Greece and on airlines the distributors agreed to reimburse him for the costs of creating these items. However, Marcus still had to pay up front and the total for just those three deals came to £10,558. Filmmakers should remember than they may need to cashflow costs like these after they have signed deals. Here are a few of the deliverable costs…

- £5,200 Full Feature 35mm Theatrical Prints

- £1,000 35mm Feature Trailer Prints

- £ 675 HD Cam SR Clone: Main film

- £ 450 HD Cam SR Clone: The Making of ….

- Soft money is vital for survival. Marcus took advantage of the UK film tax credit and it became his single largest income cheque at £158,000. However, as he paid for the film from his own funds he was not able to use any of the more tax efficient structures such as SEIS and EIS schemes. The SEIS scheme is for films of up to £150,000 (or the first £150k of a larger film) and it gives investors 50% of their investment back almost straight away. Then, if they fail to see any profits after three years they can claim a further 28% of their loss back from the taxman. The EIS scheme can support projects up £15 million and give investors slightly less back. If Papadopoulos & Sons had been funded by external private investors then they would have lost far less money than Marcus has to date.

- The publicly available data can be wrong or incomplete. At the time of writing, the Box Office Mojo figure for the UK box office is $124,794 (£84,870 in 2013 pounds). Rentrak’s official figures suggest it was nearer £96,000 and yet using Marcus’ own bank accounts we can deduce that it was closer to £165,000. This is a common complaint I’ve heard from indie filmmakers as big commercial box office trackers are not designed to catch every penny given to every small film. They don’t cover all cinemas and it can be easy to miss the odd screening for non-studio films.

- Research your marketplace. Data this candid is very hard to find but that’s not to say you can’t find some things out before you embark on the epic journey of making a feature film. Talk to other filmmakers (who over a few drink might be this candid!), attend film markets, look at what data is available online and approach sales professionals. Success if the film industry is not straightforward but neither is it random. And it only becomes clearer via experience and by accessing the experiences of others. (This point was a suggestion from Reddit).

Notes

The vast majority of data came directly from Marcus. I have cross-referenced as much as I can and it all seems to check out. In addition, Marcus didn’t just chat to me – he got his accountant to export all the transactions in the film bank account from the moment it was opened to date.

Other data came from Rentrak, the BFI, Box Office Mojo and interviews with Marcus (completed by myself and others printed online already).

Epilogue

I considered cutting this article into multiple parts but I think it serves its function best as one enormously long article.

I’ve known Marcus for a few years now and he has always been candid with this experiences and keen to speak to students of mine. I’m grateful that he was receptive to my idea of publishing the full data, warts and all. Few other filmmakers would be so open and so brave. Thank you, Marcus.

If you’ve enjoyed reading this and/or feel you have learned from Marcus’ experiences then for God’s sake buy a copy of the film. As you can see above, he would welcome the sales (plus it’s a fun film from a lovely chap).

Appendix

For those wanting more information about the film, here are a few useful data points…

Full Production Budget

See below for the full budget of ‘Papadopoulos & Sons’. The only things which have been altered is removing names and combining the cast into one line item, due to requirements from agents.

Full Income to 15th April 2015

See below for the income to date of ‘Papadopoulos & Sons’. The UK film tax credit (£158,000) is not included as it was paid into a different account. The items labeled “Deliverables” are repaying Marcus for money he has spent delivering the film to distributors. They were repaid without mark-up and so therefore are not strictly revenue (I did not include them in the income calculations earlier in the article).

Feedback on the Film

- Film critic reviews on Rotten Tomatoes (currently 77% fresh)

- Reviews from critics and bloggers via IMDb

- Audience reviews on IMDb (currently 6.1 out of 10)

Synopsis

Self-made businessman Harry Papadopoulos has got it all; a mansion house; awards and a super rich lifestyle. However, on the eve of a property deal of a lifetime, a financial crisis hits and the banks call in their huge loans. Harry and his family lose everything in an instant. Everything, except the dormant and forgotten Three Brothers Fish & Chip Shop half owned by Harry’s larger than life brother Spiros who’s been estranged from the family for years.

With no alternative, Harry and his family, plant enthusiast James; fashion victim Katie; nerdy Theo and their loyal nanny Mrs. Parrington, are forced to pack their bags, leave their millionaire lifestyle and join ‘Uncle Spiros’ to live above the neglected Three Brothers chippie. Together they set about bringing the chip shop back to life under the suspicious gaze of the their old rival, Hassan, from the neighbouring Turkish kebab shop whose son has his own eyes on Katie.

Each family member must come to terms with their new life in their own way and make the most of their reduced circumstances. Harry struggles with the banks to regain his lost business empire, but as the chip shop comes to life and old memories are stirred Harry and his family gradually discover that only when you lose everything are you free to discover it all.

About Stephen Follows: Stephen is an award-winning writer and producer based in Ealing Studios. His scriptwriting has won Virgin Media Shorts, the Reed Film Competition and IVCA awards. Stephen has also produced live events including the London Screenwriters’ Festival and the Super Shorts International Film Festival.

Copyright © 2021 Stephen Follows. All rights reserved. Reproduced with permission.

Explore more articles and research at Producers Resources.